“Change of direction”

Race against time for rare earthsSummary

Nearly all the currently operational rare earth mines are in China. Global demand is growing at an almost two-digit rate, but Peking is progressively cutting back its exports. Supply is correspondingly tight and speculators are additionally driving raw materials prices to new heights. However, it is wrong to blame China for the current problems. Western countries shut down most mines in the 1990s although sufficient resources are still available. Now a change of direction is taking place and numerous new mining projects are being planned. In 2011 the first new rare earths production operation is coming on line. But the development of capacities to meet global demand is going to be a race against time because China’s needs are also increasing and the country could soon become an importer.

1 Introduction

Hardly any discussion currently carries so much emotion as that concerning the market supply situation with rare earth metals. The financial pages of will-known newspapers talk of an ominous Chinese monopoly. China’s rapid cutback of export quotas is said to have caused the prices of “special metals” to increase five-fold within the space of a few months. The authors forecast that if China further reduces the global supply of rare earths, there will be serious supply bottlenecks in the near future. Such articles are illustrated with agency photos of mud-smeared Chinese workers and primitive-looking mine operations. Given the emotions stirred up by the subject, it is not surprising that the restrictive export policy of Peking is unanimously condemned in Western countries.

For a long time now, rare earths have been among the most important raw materials for our high-tech world. What makes them so valuable is their specific metallic, spectroscopic and magnetic properties. These special properties are behind the high performance of modern mobile phones, i-phones, flat screens, laptops, hard discs, digital cameras and energy-saving lamps. Minute magnets made from rare earth metals are contained in CNC machines, high-performance loudspeakers and headphones. Other important fields of application are electric motors, rechargeable batteries and catalysts. Without rare earth metals the progress being made with electric and hybrid cars would be impossible. The same applies to the latest-generation wind turbines and the hydrogen storage systems that are so urgently required for sustainable power supply. And many more applications could be added to this list. Alternative materials have hardly been researched and are also rare.

2 A look at the facts

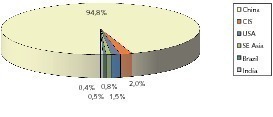

The family of rare earths includes 17 metals, 15 of which are elements in the lanthanide group, such as lanthanum, cerium, neodymium, europium and terbium, as well as two elements with similar properties (yttrium and scandium). The production output of rare earths (usually measured as metal oxide equivalent or REO = Rare Earth Oxide) has increased from around 45 000 t in 1990 to the present rate of 125 000 tpa. It is forecast that demand will rise to 190 000 tpa by 2015 and will exceed 270 000 tpa by 2020. In 1990 China accounted for less than 45 % of worldwide production output, but in 2010 it already had a share of 95 %. Fig. 1 shows the situation in 2009 when global production was 123 000 t but worldwide demand was only approx. 85 000 t due to the slump in requirement during the economic crisis. It illustrates that the lion’s share of produced rare earths comes from China. The other source countries, like the CIS countries, India, the USA and Brazil each have a share of less than 2 %.

The estimated total worldwide reserves of rare earths amount to 90–110 million t, of which China holds 30–50 million t, equal to a share of 33–45 %, which is far below the country’s present share in production output. Large quantities of these metals are also contained in deposits in the CIS countries (Russia, Kazakhstan and Kirghizia), in the USA, India and Australia – i.e. in countries that have a very extensive mining industry on other sectors. Western Europe has only small deposits of rare earths. The problem is that these metals occur in rock and clay at relatively low concentrations so that the processing is correspondingly difficult and expensive. In the 1990s, when worldwide demand was still small and the attainable prices were accordingly low, the rare earths business was not profitable enough for mining companies in the USA and Australia, so that operations there were discontinued and existing mines shut down.

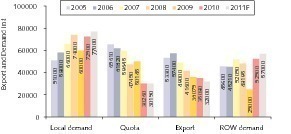

The development of China’s export quotas and the demand for rare earths in China and in the rest of the world are depicted in Fig. 2. In 2010 and 2011 China’s export quotas fell significantly to just over 30 000 t. This has caused a global supply shortage and the resultant drastic increase in prices. A smaller portion of this price rise is due to the higher export duties levied by Peking on rare earths. It should be considered that in 2009 only approx. 72 % of the export quota was actually utilized [1]. China was unable to sell the quantity produced and Western companies neglected to build up their own strategic stocks. This is all the more reproachable in view of the fact that China’s own demand for rare earths is rising and that it may well become a net importer in the future. The situation did not go unnoticed by raw materials speculators, who have been buying up the metals and thus heating up the market and exacerbating the price situation.

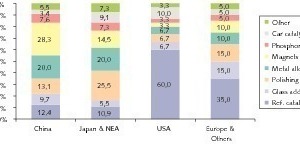

Fig. 3 shows the main rare earth applications in the most important countries and regions. The applications differ quite strongly, China and Japan, for instance, using relatively large amounts for magnets and metal alloys while the USA still has a 60 % application for cracking catalysts used in refineries and the petrochemical industry, despite the fact that alternative products with practically no rare earth content are available. In the automotive industry, catalytic converters and particulate filters for exhaust gas are the main field of application. The spectroscopic and fluorescent properties of rare earths (phosphorus powder) are utilized, inter alia, for LCDs, plasma screens, and illuminants (fluorescent substances, energy-saving lamps and LEDs). Polishing agents are primarily used for technical and optical glass (cameras) and LCDs.

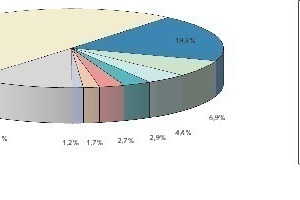

In the diagram showing the most important countries of consumption apart from China (Fig. 4), the eminent significance of Japan is obvious. Japan accounts for almost 50 % of the overall consumption, although a large portion leaves the country again in the form of export goods (cars, cameras, electronics etc.). This strongly underlines the enormous significance of rare earths for a high-tech country. In comparison to Japan, the consumption figures of the USA and particularly those of Germany are small. Germany’s demand is even lower than those of France and the Netherlands. Indeed, some raw materials companies keep a stock of rare earths that is not much smaller than Germany’s annual requirement. A number of customer firms are entering into co-operation agreements with Chinese and Japanese partners in an effort to obtain a share of the sought-after metals and thus ensure that their future business is plannable.

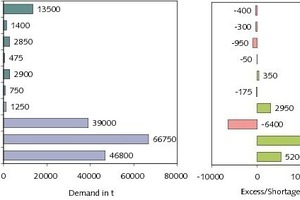

Fig. 5 depicts the expected demand for the most important 10 rare earths and shows their possible excess or shortage for the year 2015. The bottom four of the listed metallic oxides are the lighter elements and the top six are the heavier elements. As regards quantity demanded, the most important metals are cerium, lanthanum, neodymium and yttrium. The biggest supply bottlenecks are anticipated in the case of neodymium, dysprosium and yttrium, but percentage shortage figures suggest that the supply of europium and terbium will also become critical. A consideration of the price situation is also interesting. In China, Cerium – the most commonly produced element – costs RMB 160 000/t. In April 2011 the FOB price for exportation was RMB 844 000/t (US$ 130/ kg). This is a price difference of more than 500 %.

3 The Chinese production industry

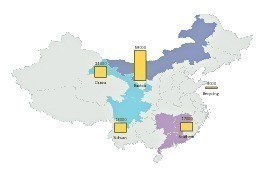

China’s total production capacity is 200 000–230 000 tonnes per year. However, approximately half of that has been shut down because the production methods do not meet today’s standards. The government has set a production target of 93 800 t for 2011, of which 80 400 t involve the light rare earth metal oxides and 13 400 t the medium-heavy to heavy ones. The majority of mining operations are located in the Inner Mongolian province in the region around Baotou (Fig. 6), where the minerals bastnaesite and monazite are extracted at a ratio of about 2.5:1, in some cases as a by-product of iron ore mining. Bastnaesite is rich in the light rare earths (cerium, lanthanum and neodymium) but only contains the heavy rare earth metals in ppm-quantities. Differing from the situation in Mongolia, bastnaesite is a primary mineral in the rock mined in the provinces of Gansu and Sichuan.

In the southern provinces of Jianxi, Guandong, Guangxi and other regions, the rare earths are a constituent of clay minerals. These types of deposit, with ion-absorbing clays, occur as products of weathering above granite rock strata and are particularly rich in heavy elements. Owing to the fact that the heavy elements like europium, terbium and yttrium fetch the highest prices and the mined quantities are so small, numerous small mining operations have sprung up in these provinces, many using obsolete production methods for which they have no licence. However, Peking has not yet managed to take all of the illegal mining operations off the market. On the other hand, in the regions concerned there is hardly any alternative work and the workers possess no other skills.

The biggest rare earths producers in China are companies operating in the north. The Baotou Steel Group of Inner Mongolia is by far the largest company, having a capacity of 65 000 tpa. If one includes the firms Baotou Huacheng RE and Baotou Damao RE, there is a capacity of over 80 000 tpa in the Baotou region alone. Second place is taken by the Gansu Rare Earth Group, which can process 30 000 tpa of bastnaesite concentrate, from which it produces 15 000 tpa of REO. Other larger producers are China Minmetals, the Sichuan Rare Earth Group and China Rare Earth. In the recent past, a number of company takeovers have occurred. For example, through its subsidiary Yixing Xinwei, China Rare Earth (CRE) (Fig. 7) took over Dongye Rare Earth and Xinghua Rare Earth and thus expanded its vertical integration. The Japanese company Showa Denko invested in Ghanzhou Zaori RE with a capacity of 3000 t.

Foreign investments in China

So-called downstream processing, meaning the concentration and refining of rare earth metals is currently arousing particular interest in China, because it offers good profit margins. This was why the China Gamma Group recently took over Mianning Mao Yuan Rare Earth, a company whose activities cover a large downstream processing segment in the Sichuan province. The US American firm AMR Technologies has purchased three processing companies: the JAMR plant in Jiangsu province which concentrates heavy elements out of ion-absorbing clays originating from the southern Chinese provinces and the ZAMR and ZAMM plants in the Shandong province which produce magnetic materials. Another trend is the formation of joint ventures with foreign companies, such as that between CRE and Osram for a production line for LCD polishing powder.

Among the largest manufacturers of magnetic materials in China are Zhongke Sanhuan High-Tech with a capacity of 12 000 tpa, Constant Magnetic Materials (6000 tpa) and four other companies with 5000 tpa each, including Yantai Zhenghai Magnetic Material and Shenzhen Shengli Magnetic Products. The ten largest companies in this segment account for a total capacity of 47 000 tpa. The biggest producers of polishing powder are Baotou Rhodia RE, Shanghai Huaming Gauna RE and Gansu Rare Earth, which each have a capacity of 3000 tpa. The ten largest polishing powder producers have a total capacity of approx. 20 000 tpa. The total number of rare earths producers in China is above 100. Other countries take a critical view of Peking’s endeavours to nationalize companies, as recently happened in Gansu.

In China the mineral ores are generally liberated by the use of sulphuric acid. In Baotou, for instance, 90 % of the concentrates are treated using the acid process. Meanwhile, the third generation of this process is in use almost everywhere [2]. This involves mixing the concentrate with strong sulphuric acid and subsequently roasting (calcining) it in a rotary kiln at temperatures of 400–500 °C. Trace substances such as iron, calcium and thorium are thereby transformed into sulphates and separated. The purified RE sulphate solution, containing around 40 g of REO / litre, is subsequently removed in a solution extraction stage (Fig. 8). This solution extraction process is based on the selective distribution of lanthanide ions between two liquid phases. This is a continuous process that is easy to automate, has a high REO extraction rate and allows the individual REOs to be separated from each other. The disadvantage is the required volume of the reaction tanks.

4 Expansion of worldwide capacities

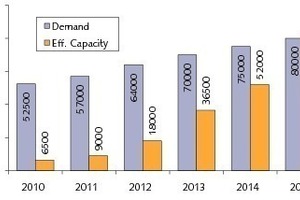

Outside China, less than 6 500 t of REO are currently produced per year. If all planned projects are implemented, this quantity could be increased to more than 80 000 tpa by 2015 (Fig. 9). This means that in a few years’ time the rest of the world will possibly become completely independent of Chinese exports. However, there are still some question marks over the planned projects. Firstly, enormous investments are necessary, the specific costs per plant being around 20 000 US$/t REO. Secondly, Western technology has hardly advanced in recent years, the project realization times are about 3–4 years and strict environmental regulations complicate the processes involved. These particularly concern the trace substances uranium and thorium, which occur in almost every rare earth deposit and have to be removed or bonded during the production process.

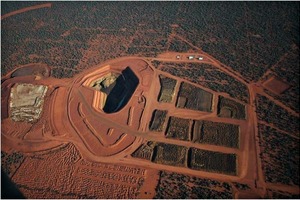

Up to now, the US American Molycorp Inc. has controlled most of the existing production outside China. In 2010, approx. 1900 t of ROE was produced from existing RE concentrates in Molycorp Minerals’ Mountain Pass preparation plant (Fig. 10) in California. Except for a pilot plant for the production of neodymium, this facility had been practically shut down since 2002. In 2010, the company started a second pilot project for the manufacturing of light and heavy REO fractions. In April 2010, Molycorp also purchased the Estonian company Silmet (Fig. 11), which has a production capacity of 3000 tpa of REO and previously mainly worked in combination with a Russian group centred on the companies Lovozersky/SMZ. Thanks to this purchase, Molycorp now has an REO capacity of around 6000 tpa and plans to produce approx. 4500–5800 t of RE materials in 2011.

Molycorp’s Mountain Pass facility is to be modernized and extended in two phases under the name Phoenix. As the first step, mining operations were recommenced in December 2010. The 1st extension phase will result in a capacity of approx. 19 000 t in 2012. The 2nd extension phase to 40 000 tpa is scheduled for completion at the end of 2013. A capital expenditure of US$ m 781 is planned for the entire project. A large portion of this sum was contained in the EPC contract (Engineering, Procurement, and Construction) awarded in July 2011 to the engineering firm KBR for the construction of a chlorine-alkali plant. Two of the most important demands placed on this plant, which represents new technological territory for the rare earths industry, are process efficiency and minimized emissions. Among the design features is totally waste-water-free operation.

The Australian Lynas Corporation also has an REO project, which differs in concept from the Phoenix project in that the RE concentration and REO production will take place at different locations. The first phase of this project will have a capacity of 11 000 tpa and is already due to commence operation in September 2011. Construction of the plant is already well advanced. The concentrate production will take place at the Mount Weld mine in Australia (Fig. 12). The process stages comprise ore crushing, grinding, flotation (Fig. 13) and fluid separation. REO production is to take place in the LAMP plant on the east coast of Malaysia, which will be extended in two phases to a capacity of 22 000 tpa. An acid process is to be used, with calcination in rotary kilns (Fig. 14) and subsequent solution extraction. To minimize emissions, the plant is to be equipped with special waste water and waste air treatment systems.

In addition to the Molycorp and Lynas projects, there are numerous other promising projects. The Stans Energy Corp. is also aiming to quickly enter the market. In May 2011 it purchased the Kashka REO production plant in Kirghizia intending to use this facility for processing the RE concentrate from the Kutessay II mine, of which Stans is the 100 % owner. The company intends to optimize the process, in order to first produce 500 tpa and later 1500 tpa of REO. The Dong Pao project in Vietnam, involving Vinacomin, Toyota Corp of Japan and Sojitz, has the objective of producing 7000 t of REO in 2012 during the first plant extension stage. Preparation is to take place in the Vietnamese plant Showa Denko, which has already been producing approx. 800 tpa of REO since 2008. Other current Japanese projects are located in India, Kazakhstan and Brazil.

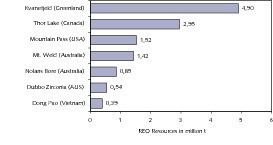

The Canadian Great Western Minerals Group is planning to put the Steenkampskraal mine in South Africa back into operation. In 2008, the Australian firm Alkane Resources already successfully started up a pilot plant (Fig. 15) for its Dubbo Zirconia project. This can not only produce zirconium and niobium but also the important metal yttrium. Another Australian company, Arafura Resources, intends to open up the Nolans Bore mine with the aim of mining 1 million tpa of ore and producing 20 000 tpa of REO at a different location (Whyalla plant). Major projects, such as Avalon’s Thor Lake Project, Greenland Minerals and Energy’s Kvanefjeld project, Hudson Resources’ Sarfartoq Project in West Greenland (Fig. 16), the Tantalus project in North Madagascar or Quest Rare Earth’s Strange Lake project will presumably not come on line until after 2015.

Fig. 17 presents an overview of the biggest current projects and the resources involved. This shows that the Kvanefjeld mine in Greenland is working the largest rare earth resource. The deposit is not only particularly large, it also contains greater concentrations of the especially sought-after heavy elements. However, the mined ore also contains larger amounts of uranium and thorium. Estimates of the available resources at Avalon Rare Metals’ Thor Lake mine have increased in recent years. In the meantime, the best estimate has reached almost 3 million tonnes of rare earths. The deposits worked by Molycorp’s Mountain Pass mine still contain at least 1.52 million tonnes, even though ore has been mined there since 1952.

5 Prospects

In the next three to four years the world will still have to rely on Chinese exports of rare earths. As from 2015, it can be expected that production capacities built up by then will cover demand outside China. However, until 2013 there will still be severe shortages in market supply, especially if China cuts back still further on its exports. China will be increasingly concentrating on supplying its own booming industry and will even develop into a future rare earth importing country.