Construction equipment sector secures jobs in a difficult environment

16.04.2021The general meeting of the VDMA Construction – Equipment and Plant Engineering on 3 March 2021 drew a positive conclusion for the past and current year. Central topics were the economic situation, the importance of the European climate goals 2050 for the industry and the development in relations with the USA after the change of government.

"We actually got off lightly. If someone had predicted at the beginning of the pandemic that the decline in turnover would only be moderate, we would not have believed it," summed up Franz-Josef Paus, Chairman of the VDMA Construction - Equipment and Plant Engineering.

© VDMA

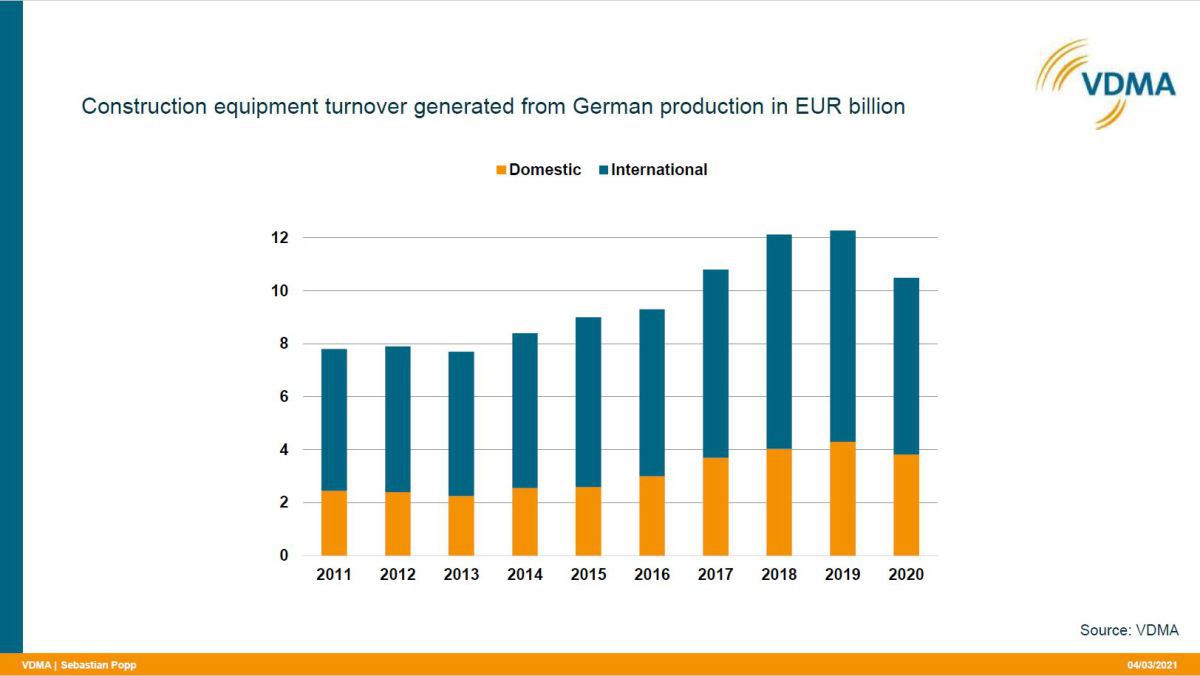

Last year, the industry turnover of construction machinery from German production was 10.5 billion €. This corresponds to a minus of 17 % compared to the high level in 2019. The sales volume is comparable to the situation in 2017. The pandemic thus did not have as strong an impact as feared in the middle of 2020.

Globally, sales of construction machinery fell by 3 % in 2020, but the Chinese market grew by 30 %, so the global market excluding China actually slowed by 17 %. In Germany and Europe, the compact equipment business was hardly affected, but the large equipment business recorded significant declines due to the higher investments required. In Germany, sales are down 7 % overall, minus 3 % for compact equipment and minus 18 % for large machinery. The fourth quarter of 2020 and the first quarter of 2021 showed increased demand, so the industry can expect an increase in sales in the first half of 2021. However, it will no longer compensate for the declines in 2020.

Optimistic look ahead

The overall mood is good, the European CECE Business Barometer is at its highest level since the end of 2018. Germany will remain stable at a high level; the European market will recover, and the global market will also grow slightly. At the moment, the economic stimulus programmes are having an effect; in the medium term, there is a risk that the public sector will be able to invest less due to the high level of new debt.

In addition to the higher raw material costs, the biggest challenge from the companies' point of view now is to organise unplannable fluctuations in the work processes. "In some cases, we had to go directly from short-time work to overtime and, in some cases, back to short-time work because deliveries suddenly stopped. In future, we will have to be even more flexible in this respect," says Joachim Strobel, Deputy Chairman of the VDMA Construction – Equipment and Plant Engineering.

The building materials plant industry is more heterogeneously positioned, so it is difficult to make precise market estimates. Long-term large orders, in part from individual companies, determine the fluctuations in incoming orders and industry turnover. There are different developments depending on the building material. Overall, the industry is on the upswing again after a difficult year in 2020, and the order intake in the first two months of 2021 makes those involved optimistic about the current year. However, there is one decisive statement for the future. "Remote services proved their worth during the pandemic and triggered a digitalisation push. These effects will remain in post-Corona times," commented Hermann Weckenmann, Deputy Chairman of VDMA Construction – Equipment and Plant Engineering.

European Green Deal 2050 - Challenge for SMEs

Jens Gieseke, CDU Member of the European Parliament and guest speaker at the General Assembly, pleaded in his presentation for a competition of innovations and ideas and spoke vehemently against overregulation and excessive bans in legislation. "One must be clear about the consequences of these serious changes, also in legislative proposals, for industry and the economy. Different technologies and ideas should be in competition with each other; an exaggerated rush to introduce categorical and, in my view, partly nonsensical bans are counterproductive and are more likely to prevent us from achieving the climate targets we are aiming for. At least not without suffering great economic damage." Gieseke advocated the appointment of an SME representative at the EU Commission to facilitate a permanent dialogue between politics and SMEs.