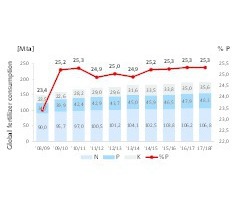

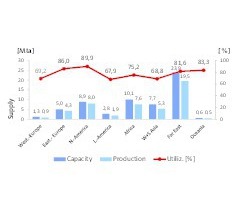

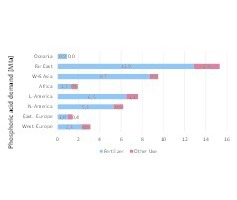

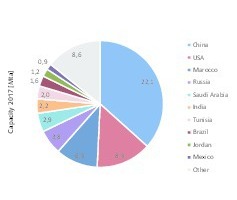

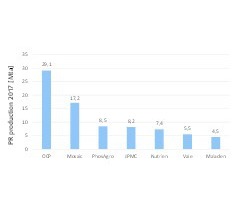

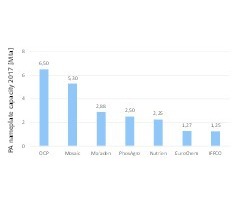

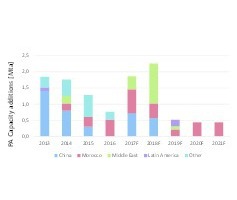

Capacities and consumption

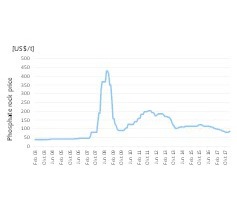

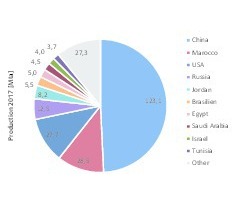

Summary: Mined phosphate rock is mainly used for the production of fertilizers and phosphoric acid. The size of the anual market is in excess of 250 million tonnes. After a long lull, prices and also capacities are showing an increase. The following market report provides information on the phosphate industry, its markets, the resources, key technologies and current market trends.

1 Introduction

The human population of the Earth currently numbers about 7.5 billion. Estimations published by the UN and the Population Reference Bureau see this number growing to just under 10 billion by 2050. The social middle class will grow rapidly and the demand for dairy products and meat is forecast to increase as well, unless eating habits change dramatically. Against this background it is clear that the production volumes of cereals, soybeans and other arable products will have to increase significantly, despite a future decrease in available cropland. Higher yields are only possible...