Hotspots

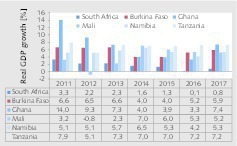

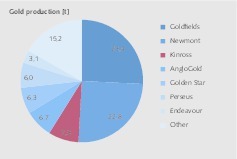

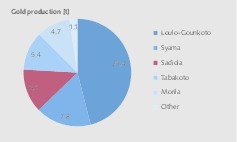

Development in mining in AfricaSummary: Despite the slump in commodity prices, some countries on the African continent – particularly in the sub-Saharan area - have achieved prominence due to their rapidly rising mining revenues. This is primarily due to the new run on gold. The following report presents these hotspot countries and their most important mining companies.

1 Introduction

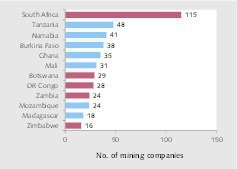

More than 430 mining companies are active in Africa. Among the most important mineral resources mined by these companies are gold, copper, diamonds, uranium ore, platinum group metals (PGM), nickel, and also coal, iron ore and bauxite [1]. According to the current state of knowledge, about a third of the global mineral resources are located on the African continent. In gold, diamonds, PGM, cobalt, vanadium, chromium and manganese, Africa holds first place in the global reserves ranking. It is therefore not surprising that the interest of global mining companies is focussed on...