New focus on rare earth elements

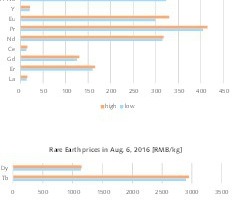

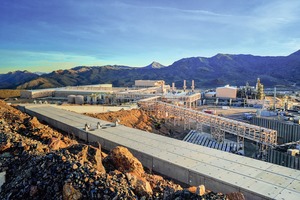

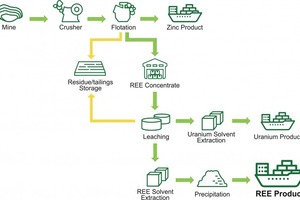

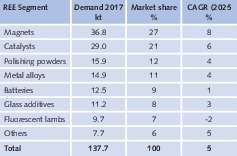

Summary: Electric cars are booming and wind farms are being vigorously expanded as part of the energy transition. Both of these technologies depend on magnets, and rare earths are indispensable for magnet production. However, the hype about these technology metals at the end of the last decade turned out to be unsustainable. Their prices plummeted and many projects have been cancelled. But now prices are rising again. The industry and the important players in the sector are well prepared. The following report presents current market figures and trends.

1 Introduction

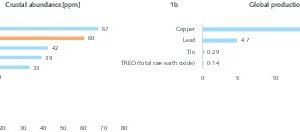

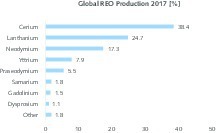

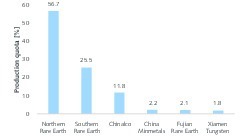

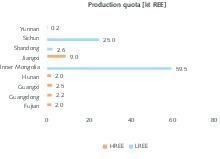

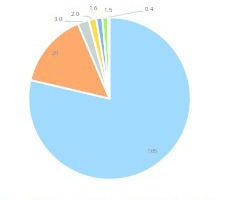

Rare earths are again in the spotlight. The global boom in electric vehicles and renewable energies is fueling a growing demand for rare earths. This group of metals has special chemical properties, which are the essential prerequisite for modern technologies and especially for numerous high-tech products [1]. In the total of 17 rare earth elements (REE), two groups are distinguished according to their atomic number in the periodic table of the elements or according to their electron configuration. The light rare earth elements (LREE) include lanthanum, cerium, praseodymium,...