Trade agreement between EU and Chile opens door to lithium companies

04.01.2023A new trade agreement between the European Union and Chile opens the door to key battery metals such as lithium. It marks an important step in supplying Europe's battery factories with the raw material. One of the beneficiaries could be CleanTech Lithium, whose shares show plenty of catch-up potential.

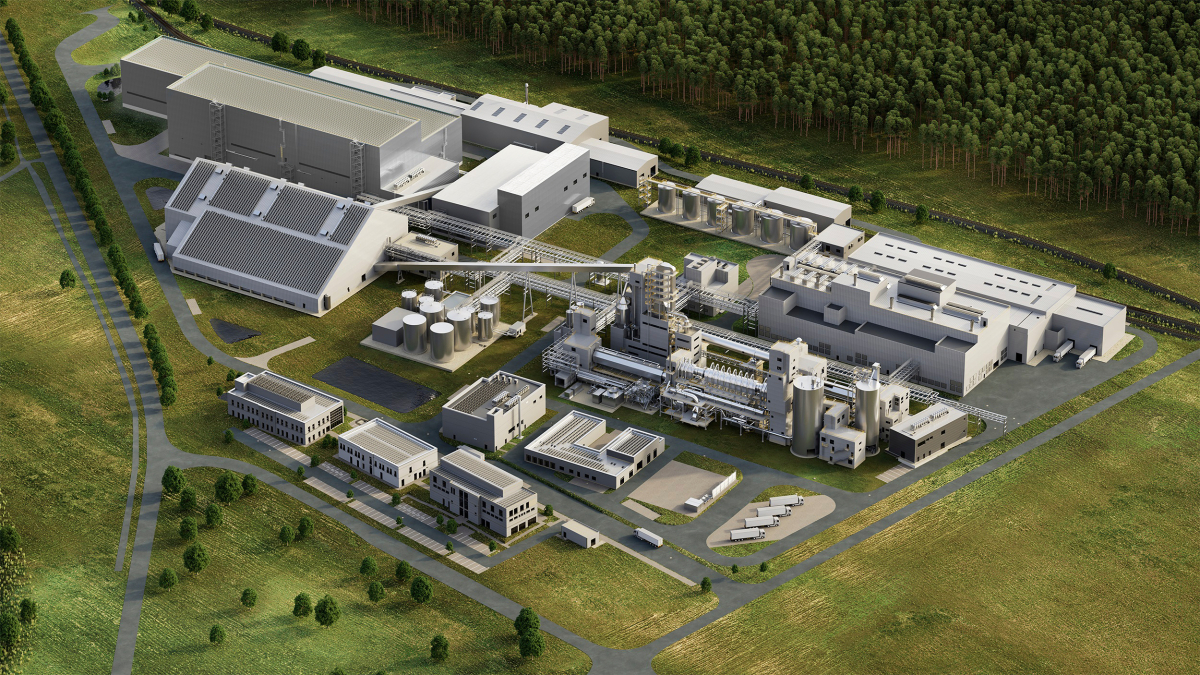

Lithium is mainly mined in the north of Chile

Lithium is mainly mined in the north of Chile

© CleanTech Lithium

Lithium remains one of the key raw materials for the electrification of transport to succeed. More than 60 countries around the world have already committed themselves to gradually abandoning the internal combustion engine and converting road traffic completely to electric drives in several steps, at least for passenger cars. This is also intended to achieve the climate targets that they have set themselves and that have been agreed internationally.

However, this also means securing the supply chains for important raw materials. Up to now, Europe has been on the sidelines. After all, there are only a few raw material projects of its own here. This also applies to lithium, a key component of batteries. A number of battery factories are currently being built in Europe. However, there is a threat of new dependencies in the supply of the necessary raw materials. In view of the events in the wake of the Ukraine war, however, this is precisely what Europeans want to avoid at all costs. In the case of battery metals, however, there is also the additional factor of competition. China is already home to the largest market for electric cars and has the largest battery capacities – and a huge demand for lithium. The USA, on the other hand, has made it clear, at the latest with the "Inflation Reduction Act", that it will not take any account of its "partners" in Europe when it comes to raw materials.

CleanTech Lithium owns three lithium projects in the north of Chile

CleanTech Lithium owns three lithium projects in the north of Chile

© CleanTech Lithium

However, Europe has now succeeded in taking a very important step. The European Union and Chile have successfully concluded negotiations on an advanced framework agreement. It is not only a geopolitical but also an economic success. The agreement, which was announced only a few days ago and hardly noticed by large parts of the German media, strengthens cooperation between the two economic areas and provides for very concrete measures. EU representatives see two key economic aspects in particular: In the future, duty-free treatment is to apply to 99.9 % of EU exports to Chile, which should boost trade. In addition, the European Union is to gain better access to the rich raw material deposits of the Andean state, especially with regard to copper and lithium.

It is important to know that the world's largest lithium deposits are located in the so-called "lithium triangle" on the national borders between Bolivia, Argentina and Chile. Among others, the two companies Albemarle and SQM, the two largest lithium producers in the world, are also active in Chile. In the country, lithium is mainly mined in the Salar de Atacama in the far north of the country. The framework agreement, which still has to be ratified in spring, will give Europeans access to these deposits.

One of the most promising lithium companies in Chile is CleanTech Lithium. The company, which is listed in London and Frankfurt, owns three lithium projects in the north of the country, with Laguna Verde being the most advanced. Mining could begin here as early as the end of 2025. It is currently working to increase the size of the resource, which already includes 1,5 million tons with 206 mg/t (Li2CO3). According to analysts, it could double the resource with the new drilling campaigns and subsequent studies. In addition, a scoping study is underway that will provide a first look at the project's economics. It is expected to be published before the end of the year. In addition to "Laguna Verde", CleanTech Lithium has a second deposit, Francisco Basin, which is believed to have at least a similar potential. In any case, the analysts' guide agrees that the Company, which currently has a market value of about 47 million pounds, has great potential. Canaccord Genuity has issued a share price target of 290 British pence, but only the Laguna Verde project was included. If both projects are included, the price target rises to 545 pence. Thus, the share has the potential to multiply significantly.