Trends in the crusher market and operational challenges

The markets for crushers is huge, but just as huge are the operational challenges as the demand for mobile crushers is steadily growing. Mobile crushers only manage around the half the lifetime of stationary crushers and, on top of that, they are more expensive, which illustrates one aspect of the problem. In the following paper, current figures on the crusher market are presented and explained. The author also discusses how the challenges are being tackled by the crusher manufacturers.

1 Introduction

Crushers are used for the comminution of lumps of material down to the millimetre range and are widely implemented in the industrial processing of mineral resources and waste-derived secondary materials [1]. Typical applications are found in mining, in quarrying for production of aggregate or to obtain raw materials as well as in the recycling of construction waste and asphalt. However, the requirements for crushers differ in mining and quarrying. Whereas in mining, the focus is on primary comminution of ores to defined finenesses, at quarries the aim is to produce specific rock aggregates with maximized cubic particles, but without an excessive content of fines, which are not useful in the production of concrete.

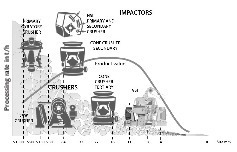

Despite different applications, essentially the same crusher types are used in the various sectors, although these are selected based on different priorities. Fig. 1 shows the key crushers in quarries for the production of aggregates and raw materials. Here, the feed and crushed particle sizes along with the size reduction ratios achieved by the crushers play an important role. For primary comminution, gyratory crushers, jaw crushers and horizontal-shaft impact crushers (HSI) can be used. Cone crushers and vertical-shaft impact crushers are used mainly in secondary and tertiary comminution. Besides the above-mentioned crushers, there are also numerous speciality machines such as hammer crushers, roller crushers, etc. Crushers can be designed as stationary machines, but also as mobile machines (on wheels or crawler chains) or semi-mobile machines.

2 Market and market development

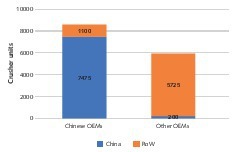

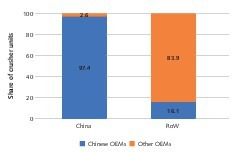

At the beginning of 2021, OneStone Consulting conducted a market survey on the individual crusher types and their most important applications. In this survey, a total of more than 50 manufacturers were surveyed, around 20 of them in China and around 30 manufacturers in the rest of the world. A large number of companies supplies crushers for different applications in mining, quarrying and recycling. Many manufacturers have specialized in just one or two fields. For the market survey and the number of sold crushers, a time period from 2017 to 2019 was chosen and annual average was calculated from the figures. However, only crushers with throughput rates > 20 t/h were included, while numerous speciality applications (metals, refuse, etc.) were excluded. From the survey, a total figure of 14 500 crushers on average resulted, including 7675 for the market in China and 6825 in the rest of the world.

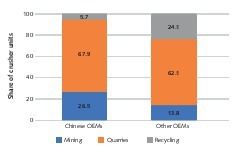

Fig. 2 shows how many crushers are manufactured by the global OEMs (Original Equipment Manufacturers) for the various markets. The Chinese manufacturers with 8575 crusher units reach a global market share of 59.1 %, while the manufacturers outside China manufactured a total of 5925 units or 40.9 %. Striking is that the latter only produce a good 200 crushers for the Chinese market, while the Chinese manufacturers supply 1100 crusher units to the market outside China. Fig. 3 shows this situation clearly with reference to the percentages. The manufacturers based outside China only have a market share of 2.6 % in China, while the Chinese manufacturers get up to a market share of 16.1 % outside China. In the figures for the exports to China, it is striking that these can be mainly attributed to mobile crushers.

Fig. 4 shows how the unit figures of the worldwide OEMs are distributed over the key industries. The mining sector covers the beneficiation of metal ores, coal and other minerals, like, for example, phosphorous. Quarrying includes the production of aggregates but also the processing of raw materials such as clay, limestone, marl, gypsum and similar raw materials. The recycling sector refers to the processing of building rubble, asphalt, slag, glass, ceramics, plasterboard and similar products. The largest percentage of supplied crushers are found in quarries with 67.9 % and 62.1 %, respectively. While for the Chinese OEMs, the mining sector has the second highest share with 26.5 %, for the OEMs outside China the recycling sector clearly holds second place with 24.1 %. The coal industry accounts for a large part of the crushers of the Chinese OEMs in the mining sector. Besides China, other countries in the Far East and, for example, in the CIS states are supplied.

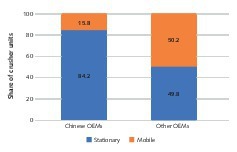

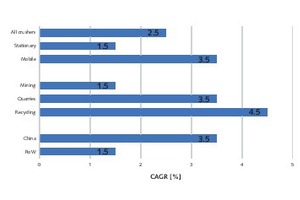

Fig. 5 shows how the unit figures for stationary crushers and mobile crushers are distributed over the OEMs. While the manufacturers outside China manufacture as many mobile crushers as stationary crushers, the share of mobile crushers manufactured by the Chinese OEMs still lags far behind. But in China, too, there is a trend towards mobile crushers. Overall, the market in China is growing faster than in the rest of the world (Fig. 6). This can be attributed, on the one hand, to the greater economic growth there, but also to a large extent to pent-up demand for the production of aggregates [2]. Up to 2025, the figures for mobile crushers will increase twice as fast as those for stationary crushers. Worldwide, the greatest growth is in the recycling sector. This is linked to the growing political demands for the better utilization of resources and lower environmental impact.

3 Technical developments

Up to just a few decades ago, almost exclusively stationary crushers were used for the processing and comminution of ores, rocks and building rubble. In the meantime, mobile crushers are gaining ground. Most mobile crushers are rock-crushing machines mounted on crawler tracks that can be moved easily within and between production sites. They are now the most common solution implemented in quarries for the production of aggregates and in recycling applications. In these applications, mobile crushers can completely replace stationary crushers, which reduces the demand for transportation and fuel costs and therefore lowers operating costs. The cost efficiency of mobile crushers increases proportionally to the distances in the quarries and the routes to the crushers.

In principle, it is the same situation in the mining sector, however, the circumstances are more complicated. First, gyratory crushers are often used as primary crushers for throughput rates up to 15 000 t/h or several million tonnes per annum. Such crushers (Fig. 7) are profiting from the decreasing metal content in ore and reach tare weights over 500 t. Newer generations of gyratory crushers are increasingly designed as semi-mobile machines, to, for a relatively low size reduction ratio, make the overburden suitable for conveying on a belt. The crusher location follows the mine development or is adapted as needed. Basically, however, jaw crushers or combined jaw-gyratory crushers should be used as primary crushers where possible as these are easier to handle and require lower investment.

Several secondary and tertiary crushers are installed downstream of the primary crushers. In mine operations, mostly several cone crushers are used. In isolated cases, jaw or impact crushers may be used. Typical for the use of cone crushers (Fig. 8) in mining operations are stationary processing plants, which, besides the crushers, comprise downstream equipment such as mills and flotation equipment. The reliability of the crushers is at the crux of such facilities so that mechanical availabilities > 95 % are specified. If the crushers were to shut down outside of the scheduled maintenance intervals, the consequence would be high financial losses. The manufacturers are therefore making great efforts in machine monitoring, automation and digitalization. With every new machine generation, advances are made and often packages for retrofitting old crushers are offered.

In quarries, fewer gyratory crushers are found in use. The workhorse for primary crushing here are jaw crushers (Fig. 9). If the material hardness of the materials is below 5 Mohs, horizontal-shaft impact crushers (Fig. 10) and hammer crushers can be used directly as primary crushers in these applications as these machines achieve high size reduction ratios in the range from 8 to 40. Almost all OEMs have put great deal of work into the development of mobile crushers in recent years. It is about much more than just making the machines movable on crawler tracks. Mobile crushers are exposed to greater stresses than their stationary counterparts. This is because a uniform material feed cannot be guaranteed and as a result the machine wear increases. Another reason are the limited maintenance options for machines out in open terrain.

Requirements to be met by mobile crushers are increasing, especially for the recycling of building rubble. Inhomogeneous materials, impurities, uncrushable components, and changing application sites cause greater problems than at a quarry. The machine operators often don’t have the same know-how as the quarry operators, who usually have many years of experience in the maintenance of machines. The manufacturers are trying to get round these difficulties with simplified machine concepts, easy handling and adapted new machine models (Fig. 11), to achieve reasonable machine availabilities. Therefore, particularly for mobile crushers, a high innovation rate can be established. The focus is on a rugged design, intelligent and simple operation options, safety concepts for machine operation and good accessibility to wear and service components for easy maintenance are available.

Huge leaps in innovation for the crusher models cannot, however, be expected as the machine concepts have been established for several decades and have often already reached the third and fourth machine generation of a certain type of crusher. Only the so-called roller crushers or RollSizer (Fig. 12) have got people talking with new variations in recent years. Here, more and more suppliers are entering the market. One such new development is the eccentric roller crusher (ERC) from thyssenkrupp Industrial Solutions. The ERC (Fig. 13) combines the ability to process hard rock material, with a flat machine concept. This leads to lower installation height and machine weight and therefore caters especially for the increasing trend of underground pits in mining. The roller crusher can be easily used for wet and sticky material as well as for hard rock without any problems.

4 Operational challenges

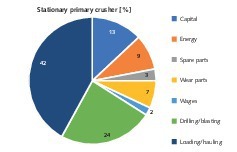

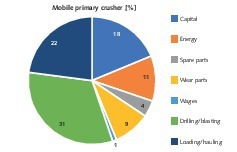

A comparison of processing costs with different crusher types is often done in practice, however, this is not very easy. In Fig. 14A and Fig. 14B, the typical annual cost breakdowns for stationary and mobile jaw crushers are shown for the use of these jaw crushers as primary crushers. Stationary jaw crushers show advantages compared with mobile crushers in terms of capital costs as well as replacement part and wear costs. Also the drilling and blasting costs in the quarry are not as high for stationary crushers as a wider range of feed materials can be processed. Whether these cost disadvantages for the mobile crusher can be offset is decided essentially by the costs for the material transport to and from the crusher and loading of the transport vehicles.

A comparison becomes more complex when the different lifetimes for the crushers are considered. On the one hand, shorter lifetimes increase the annual capital costs because of the shorter depreciation periods, on the other hand, however, lower residual values can be achieved for an intended resale. In the end, a comparison becomes practically impossible when different annual operating hours and different shift operations are costed. In stationary crushers the crusher lifetime is designed to match the expected operative running of the plant. In mining, this is usually the expected lifetime of the mine and often ranges between 20 and 25 years. The crusher is expected to function for this period of time.

If mobile crushers are to be used in quarries, then it is not rare for the operators to want a lifetime of 20 years for their fleet of machines, including the crusher. The manufacturers of mobile crushers usually specify just ten years for the crusher lifetime. To enable the use of a mobile crusher nevertheless, a comprehensive and predictive maintenance concept is agreed between the operation and the OEM. This shows the importance of maintenance concepts for the crusher lifetime. The leading OEMS therefore offer different “Life Cycle Services”, catering for the different needs. These services range from scheduled inspections to maintenance and wear part optimization to process optimizations. Besides these, customized solutions are offered.

Measurement of the overall equipment effectiveness (OEE) for crushers has pivotal importance [3]. As researchers at the Chalmers University of Technology in Gothenburg, Sweden, have established, the OEE for cone crushers in mineral processing and aggregate productions is often very low (< 50 %) prior to optimization. The explanation is an unfavourable crusher feed or inadequate crusher control. Crusher feed should be as good and evenly distributed as possible (Fig. 15). In many installations, the feed to the crusher is separated from the crusher and not geared properly to the crusher. When the properties of the feed material change or the steel linings of the crushing chambers become worn, this leads to a drifting of the crusher setting, which must be remedied by the control system.

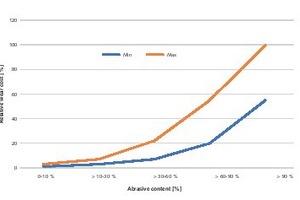

Considerable attention is given to machine wear and the wear costs. Fig. 16 shows the relative wear costs for crushers as a function of the abrasive components in the crusher feed. Such abrasive components in minerals include, for example, silica (SiO2), iron oxide (Fe2O3) and alumina (Al2O3). While the relative wear costs for abrasive components < 30 % remain under 10 % even in the most unfavourable case, the wear costs for abrasive components > 30 % and < 60 % can already rise to 30 %. The wear costs rise exponentially with the increasing content of abrasive components. In certain cases, this can lead to wear parts having to be replaced within 200 operating hours while in other cases the wear parts last over 5000 operating hours.

To minimize wear in crushers, practically since the market launch of crushers around 150 years ago, new concepts and materials have been constantly developed, improved and optimized. Over the years, for example, manganese alloys have proven reliable, but there are limits to the maximum manganese content in the wear-resistant casting on account of increasing embrittlement. A wide range is available for the impact bars in impact mills. In the field, numerous materials have proven effective for the production of impact bars for the different applications. Worth mentioning are: manganese and chromium steels, steels with martensitic microstructure as well as metal-matrix composites in which various steels with a special type of ceramic. Wear part specialists sometimes more material knowledge than the crusher OEMs, leading to wide competition in the sector

5 Outlook

The market prospects for crushers are rosy. This is largely down to the increasing shortage of resources, which is impacting us on several levels. In mining we have to contend with decreasing metal content in the ores, making processing rates steadily higher. In the production of mineral aggregate for the construction and concrete industry, we are increasingly dependent on machine-produced products as natural resources for sand and gravel, e.g. from river valleys, are becoming scarcer. In the case of building rubble and other recycling products, there has recently been a veritable boom with a positive impact on the market for crushers. With the market developments and a higher demand for environmentally friendly solutions and for climate protection, there is a trend towards mobile crushers.

At the same time, with mobile crushers it is not possible to achieve a lifetime as long as for stationary crushers. As a result, the number of necessary crushers will rise in the future and annually increasing sales figures result. As the market survey shows, Chinese suppliers are gaining ground worldwide. The suppliers outside China are still regarded as market and technology leaders – especially for crushers for the mining sector and in the segment for mobile machines. For these manufacturers to continue leading the market in future, further development steps are necessary. These include besides improved machine engineering, new control and automation concepts as well as simplifications and greater safety in handling the crushers. Another important aspect are advanced servicing and maintenance concepts.

Literature:

[1] Harder, J.: Trends in the grinding of hard rock for raw materials extraction. AT AUFBEREITUNGS TECHNIK/Mineral Processing, 49/2008, Nr.8, pp. 38-48

[2] Harder, J.: Sand as raw material – a scarce commodity? AT MINERAL PROCESSING, 01-02/2020, pp. 48-60

[3] Evertsson, M.: Cone Crushers – Understanding and Improving the Performance. Presentation at The Global Comminution Collaborative (GCC) by Prof Magnus Evertsson – 25 February 2021. Department of Industrial and Materials Science, Machine Elements, Rock Processing Systems, Chalmers University of Technology, Göteborg/Sweden

Author:

Dr.-Ing. Joachim Harder, OneStone Consulting Ltd., Varna/Bulgaria

Joachim Harder (1952) studied process engineering at Braunschweig University of Technology and earned his Ph.D. there. After more than 10 years working in industry in various management posts, in 1997 he established the consulting company OneStone Consulting. Dr. Harder is an acknowledged expert in international marketing, specializing in market analysis for business segment strategies. He is the author of diverse publications and a popular conference speaker.