Company insights

Rare earths, heavy mineral sands, niobium and tantalum as well as the battery raw materials lithium and cobalt are some of the critical resources that are subject to a high supply risk. A lot is written about from where these materials are sourced, but only limited information is available on the companies engaged in the extraction of these resources. Which companies are they and how cost efficient is their extraction. This article provides some answers.

1 Critical resources – a situation analysis

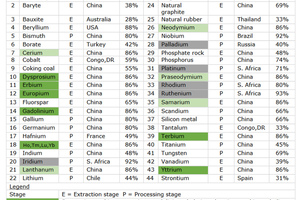

Hardly any other topic is the subject of so many reports as critical resources. These are mineral resources of key economic importance but subject to a high supply risk. Reliable and assured access to these resources is a critical issue not only for us, but all over the world. In the EU, since 2011, a list of these critical resources has been compiled. This list is reviewed every three years and updated as necessary [1]. The current list comprises 44 critical resources (Fig. 1), instead of 30 if a differentiation is made between heavy and light rare...