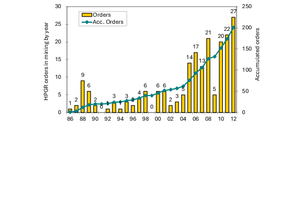

Current market trends for HPGRs in the mining sector

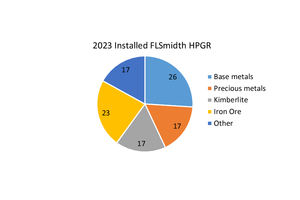

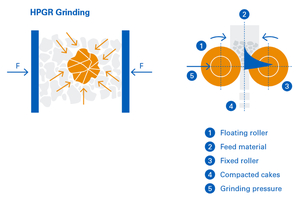

HPGRs have developed into an efficient process for grinding ore. On account of the high savings in the specific grinding energy required, not only large quantities of energy are reduced in ore beneficiation plants, substantial CO2 savings can be achieved, too. In the following paper, the spotlight is on current developments.

1 Introduction

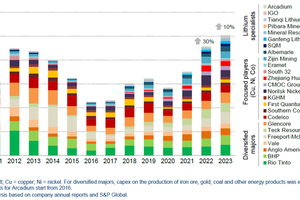

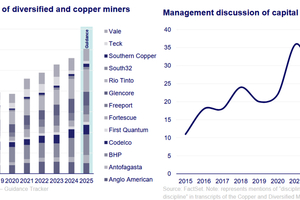

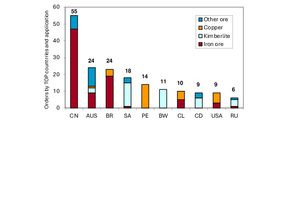

The quantities of energy used for grinding ore account for around 2 % of global energy consumption. This has become an increasingly important aspect in mining, which can be attributed to the fact that the quantities of ore extracted are steadily increasing to make up for the decreasing content of metal in the ores. This does not even include the investments in new mining operations expected over the next few years. Current figures assume that the global demand for copper alone will increase by 70 % by the year 2050. High growth rates are also expected for other metals, and the...

![3 Energy requirement and copper content [8]](https://www.at-minerals.com/imgs/2/2/6/5/5/5/3/tok_c91cf0105cc3ffe8d549148853c5c6ca/w300_h200_x600_y372_03_Bild3L_Ballantyne1-1eecb711427d6f9f.jpeg)

![16 Comparison between ball mill and HPGR [12]](https://www.at-minerals.com/imgs/2/2/6/5/5/5/3/tok_b095ebb468f45ca8353eb974cfc56acb/w300_h200_x297_y421_16_Harder_Ball_mills_1-fa8d5886ea9ca23e.jpeg)

![17 Energy comparison between SAG and HPGR [13]](https://www.at-minerals.com/imgs/2/2/6/5/5/5/3/tok_f3094732d2351e96b868deb79852bd08/w300_h200_x421_y297_17_Harder_SAG_Energy_NEU-0b71ad12c895b8f1.jpeg)

![18 Investment comparison between SAG and HPGR [13]](https://www.at-minerals.com/imgs/2/2/6/5/5/5/3/tok_407719267173c8c18f5a6a6a416ef67f/w300_h200_x297_y421_18_Harder_SAG_Invest_1-4674e08067b6595d.jpeg)