Development of the mining sector in India

In recent years, India has registered rapid growth. The mining industry has also profited from this. However, in India, time seems to go more slowly, which you can see from the fact that India’s mining sector still does not yet attract a great of international attention. What is the situation in reality? This report provides an analysis and interesting answers.

1 Economic development

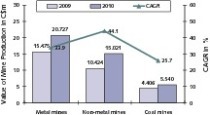

India is now the fifth largest national economy in the world and, with sustained growth, it will rank third behind the USA and China by the end of this decade. Despite significant success in the fight against poverty over the last decade, India remains a country of opposites, with an extreme contrast between rich and poor. Fig. 1 shows the forecasts for economic growth for the upcoming years according to the WEO (World Economic Outlook) issued by the International Monetary Fund in April 2023. In 2020, with 5.8 %, India had to shoulder more severe losses in its GDP than...

![3 Self-sufficiency with mineral resources [2]](https://www.at-minerals.com/imgs/1/9/9/6/0/4/3/tok_404fee78052d57127973a27148a0eba0/w300_h200_x297_y421_03_Harder_Selbstversorgung-5340571bcc67b77c.jpeg)

![8 Iron ore production in India [2]](https://www.at-minerals.com/imgs/1/9/9/6/0/4/3/tok_7f9eef300820a1669d7095f8e9add527/w300_h200_x297_y421_08_Harder_Eisenerz-ce42f65a5d18608c.jpeg)

![10 Manganese ore production in India [2]](https://www.at-minerals.com/imgs/1/9/9/6/0/4/3/tok_197604e4a0e86b84c42797ae0c8f4cfb/w300_h200_x297_y421_10_Harder_Manganerz-8b5429cd64f4a1f8.jpeg)

![12 Bauxite production figures in India [2]](https://www.at-minerals.com/imgs/1/9/9/6/0/4/3/tok_8143b722d4ead124e506928ffae009ca/w300_h200_x297_y421_12_Harder_Bauxit-e44fadcb28a30ea6.jpeg)

![14 Production figures for selected metals [2]](https://www.at-minerals.com/imgs/1/9/9/6/0/4/3/tok_8dd1a03205a2ec9cc6da7888bcb45b26/w300_h200_x297_y421_14_Harder_Metalle-4c6335e43c0ccc8f.jpeg)