Forecasts for the further development of the mining industry in 2023

The mining industry is bracing itself for a turbulent year in 2023. In this article, various key trends are discussed. These include the investment situation, developments in the mining of coal and iron ore, precious and industrial metals, and battery raw materials, China’s demand for raw materials as well as other geopolitical and economic developments.

1 Muted optimism for 2023

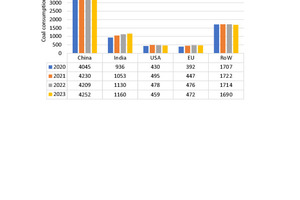

For 2023, a higher demand for metals is expected worldwide. The pressure of inflation is easing off, as are constraints in the supply chain. That could mean that the global economic slump from 3.2 % growth in 2022 to 2.7 % in 2023, as currently forecast by the IMF in the current Word Economic Outlook (WEO), will not be as severe as expected. A recovery in the automotive sector and in renewable energies could help offset a part of the weaker demand in other consumer-oriented markets.

Despite that, many are expecting a turbulent year in the mining sector. The reasons for...

![11 Market development for cars and utility vehicles [4]](https://www.at-minerals.com/imgs/1/9/3/7/6/8/4/tok_00684e5cea62932c5777b9936f35c75f/w300_h200_x297_y421_11_Harder_Nutzfahrzeuge-317d7efda135cd46.jpeg)

![12 Market demand for lithium batteries [5]](https://www.at-minerals.com/imgs/1/9/3/7/6/8/4/tok_90032aa1a7d71c099c62008d788b7e8b/w300_h200_x600_y309_12_Bild12L_Lithium_McKinsey-48aa6f7419a13510.jpeg)