Dry beneficiation of iron ore

Falling prices for iron ore with lower quality than 60 % Fe have led increasingly to the design of iron ore beneficiation lines. General problems of water scarcity and risks with tailings dams have led to the focus shifting to dry beneficiation technologies. In the following article, current developments are examined and case studies referenced.

1 Introduction

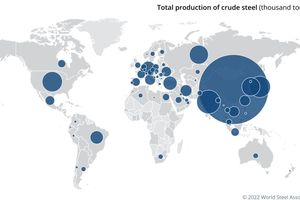

According to figures released by the Worldsteel Association, the production of crude steel has more than tripled since 1970 from 595 million tonnes per annum (Mta) to 1952 Mta in 2021. Fig. 1 shows the current shares in crude steel production of individual countries, the size of the circles being proportional to the respective production volume. China alone accounts for 52.9 % of the global production volume. Following in the ranking are India, Japan and the USA. Germany is the largest producer in Western Europe, but accounts for only around 2 % of the global production. Forecasts of global growth up to 2030 and 2040 are influenced by two parameters in particular: China’s future demand and the necessary efforts of the steel industry to reduce CO2 emissions. Therefore, it is expected that crude steel production will only increase annually by 1 to 2 %. There are, however, more and less optimistic forecasts.

According to Worldsteel, of the global crude steel production totalling 1875.3 Mta in the year 2019, 70.8 % or 1327.1 Mta were produced by blast furnaces while 111.3 Mta was sent to direct reduction processes. For this purpose, in 2019, a total of 2315,7 Mta iron ore with an iron mineral content of 1436 Mta and an average iron content of 62.0 % was used. The most important iron ores are haematite (Fe2O3) with up to 69.9 % iron content, magnetite (Fe3O4) with up to 74.2 % and siderite (FeCO3) with up to 48.2 % iron content. However, the ore deposits also contain impurities (gangue) like silicates or silicate-containing rock, and magnetite ore can rarely be extracted with an iron content higher than 50 %. Iron ore with a high iron content above 62 % has become scarce and expensive. While higher prices can be obtained for high-grade iron ore, the extraction of low-grade iron ore is becoming increasingly uneconomic owing to falling prices.

2 Iron ore reserves and lifetimes

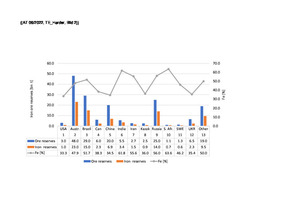

According to current figures released by the US Geological Survey (USGS), in 2019, the global iron ore reserves totalled around 179 bill. t with an average iron content of 47.6 % or 81 bill. t iron. Fig. 2 shows the distribution of the volumes across the key mining countries. Measured in terms of iron content, Australia leads with 23 bill. t, ahead of Brazil (15 bill. t) and Russia (14 bill. t). Australia also leads with regard to iron ore reserves with 48 bill. t, ahead of Brazil (29 bill. t), Russia (25 bill. t) and China (20 bill. t). The average iron ore content in the reserves, however, differs widely. The highest contents are found in South Africa, India, Russia, Iran and Brazil, the lowest in Canada, Kazakhstan, Ukraine, China and the USA. Australia and Sweden take the places in the middle.

The largest volumes of iron ore are mined in Australia with 930 Mta, Brazil with 480 Mta, China 350 Mta, India 210 Mta and Russia 99 Mta. With a worldwide mining rate of 2450 Mta, the calculated lifetime of the known reserves is around 69.4 years. Reserve refers to the quantity of ore that can be economically extracted with today’s technology. Added to the reserves can be detected resources that may be economically extracted at a later point in time. Based on the example of Australia, these figures are clarified in the following. There, at 34 iron ore mines in operation in 2018, around 900 Mta iron ore are extracted. These mines have reserves of 11.6 bill. t and detected resources of 25.5 bill. t and reasonably assured resources of 40.1 bill. t.

Accordingly, in Australia with the existing extracted quantities, the lifetime of the reserves is 13 years, and those of the detected and assured resources 28 and 73 years, respectively. With the further mining of the reserves, the iron ore contents of the mines are also shrinking. This has already been shown clearly in China and the USA, where the average iron ore content is only around 34.5 % and 33.3 %, respectively. As a result of ever more mines running dry, to ensure constant global mining quantities, it is necessary to tap into around 60 Mta new iron ore. The cost of iron ore beneficiation is rising, and existing wet technologies are reaching their limit for various reasons, like the high water requirement or hazards as a result of tailings [1; 2]. The trend today is towards dry iron ore beneficiation.

3 Technologies for iron ore beneficiation

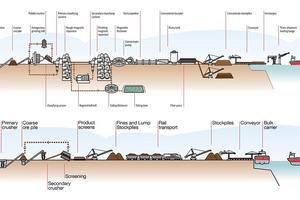

Depending on iron content, beneficiation of iron ore for sale is a relatively simple to complex process. In Fig. 3, the typical beneficiation of the oxide iron ores magnetite and haematite are shown. Easiest to beneficiate are haematite ores (bottom part of the picture). In simplified terms, the process steps comprise “Mine-Crush-Screen-Sell” and are also described as DSO process (DSO = high-grade direct shipping ore). On account of the low process costs, DSO ores with iron content of 58 % are produced. For magnetite ores, beneficiation is typically more complex with finer ore grinding and downstream DMS (Dense Media Separation) and LIMS (Low-Intensity Magnetic Separation) separation processes. For DMS and LIMS, various technologies are used.

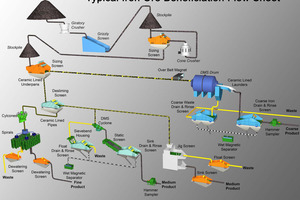

Fig. 4 shows the process stages of a possible iron ore beneficiation for magnetite ores or also siderite and taconite ores that have only a low to medium iron content. After comminution and screen sizing, the coarse ore and fine ore streams are treated separately. The coarse ore stream is fed to a DMS trommel and then wet screen classification. The fine ore stream is deslimed and the overflow is then further processed in a DMS cyclone (Fig. 5) and/or a jigger. Alternatively, WHIMS processes (WHIMS = Wet High-Intensity Magnetic Separation) are used. The fine ore from the underflow is sent on the other hand to a spiral classifier, where density separation of the metal ore and gangue taking place in several stages. For even higher iron yields, flotation can be installed downstream of classification.

Whereas the DSO processes with comminution and screen classification can be designed as dry processes, the above-mentioned downstream beneficiation processes are generally designed as wet processes. In the meantime, there are also plants and process steps that can be designed as dry processes. These include, for example, dry jiggers, fluidized bed separators and dry magnetic separation processes for fine separation of magnetite ores. For dry magnetic separation, in recent years, especially in Australia, China and India, various processes have been developed. A first industrial process has now been launched onto the market by Vale with the FDMS process (FDMS = Fine Dry Magnetic Separation) (Fig. 6) in which rare earth high-performance magnets are used and enable concentration of the magnetite to an iron content of 68 %.

Vale is endeavouring to switch its iron ore beneficiation largely to dry processes. The gangue types like silica is separated from the up to 15 % moist ore from the surface mines by means of dry screening (Fig. 7), with no water being added to the process. This is enabled by newly developed vibrating screens. For this, Haver & Boecker NIAGARA has developed innovative screening technologies with high level acceleration that contribute to prevent clogging of the screen media by the sticky and extremely abrasive ore. As screening surfaces, special PU hybrid materials are used.

4 Various case studies

4.1 Australia and South Africa

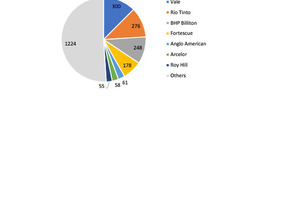

Iron ores for export come almost exclusively as so-called DSO ores on the market, Dominant worldwide is a group of five producers like BHP Billiton, Rio Tinto, Anglo American, Fortescue and Vale, which produced around 45 % of the global iron ore (Fig. 8) in 2020 and are responsible for around 85 % of the worldwide export quantities shipped to China, Europe and other countries. The companies are able to produce iron ore with 62 % iron content at cash costs of 15 to 18 US$/t, FOB port of loading, although with the relatively large price fluctuations for iron ore on the international spot market, good profits can still be obtained even with prices falling below 50 US$/t. Companies that only have iron ores with low iron content cannot keep pace in the export business, but can generally produce material for their own steel production cost-efficiently.

In 2020, BHP Billiton produced around 248 Mta iron ore. In the Pilbara region in Western Australia, it operates five mines and two beneficiation hubs. By June 2021, it had detected iron ore reserves of 1 850 Mt with an average iron content of the mines from 56.9 % to 62.8 %. From the Jimblebar Mine (Fig. 9), so far an iron ore with 60.5 % iron content has been produced in the DSO process as “fine blends”. With regard to revenue, however, BHP had to accept a discount of 20 $/dry metric tonne (dmt) compared to the reference prices for 62 % iron ore. The company is therefore planning to set up a beneficiation line for 60 Mta ore by 2024 with the goal of increasing the iron content in the product. However, the company has opted for beneficiation with wet screens, DMS cyclones and belt filters for thickening of the tailings.

Rio Tinto, the largest Australian producer of iron ore produced 319.7 Mta iron ore (266.8 Mta iron content) in the Pilbara region in 2021 and obtained average prices of 132.2 $/t FOB (with 8 % moisture content). The company has 16 mines, several beneficiation lines, four port terminals and 1700 km railway network (Fig. 10) to the ports. Five different products are produced, including the so-called Pilbara Blend. The ore reserves total 3050 Mt. In 2018, the Gudai-Darri (Koodaideri) iron ore project was started up with a capacity of 43 Mta, which is going into operation in the second half of 2022 with one beneficiation line for Pilbara Blend. Mine and beneficiation line are equipped with the latest technology. Dry comminution and screening are to be applied. Coarse- and fine-grained HG (high-grade) iron ore are produced.

Since its founding in 2003, the Fortescue Metals Group has advanced to become the third largest Australian iron ore producer. In the business year 2021, 182.2 Mta ore was produced for export to China, Japan and South Korea. In the Pilbara region, the company operates the three mines Western Hub, Solomon Hub and Chichester Hub with the ore beneficiation plant Christmas Creek (Fig. 11). Before the end of 2022, the portfolio is to be widened in the Pilbara region with the addition of the Iron Bridge project. This is a magnetite mine that will supply 22 Mta iron ore in the first phase of development [3]. The investment costs amounted to 3.3 to 3.5 bill. US$. In the beneficiation plant, high-pressure grinding rolls (HPGR) with downstream dry screening and dry magnetic separation are used as tertiary crushers to obtain a concentrate with 67 % iron content.

In 2013, CITIC Pacific Mining had put into operation a first line from a total of six for the production of a magnetite iron ore concentrate in the Pilbara region. The capacity of the Sino-Iron project (Fig. 12) is 180 000 tonnes per day or 24 Mta. In contrast to the Iron Bridge project, wet beneficiation with SAG mills, wet ball mills and wet magnetic separators are used. The HQ-magnetite concentrate is supplied to buyers in China, who appreciate the high iron content of 65 % and low content of product impurities.

Another of the big iron ore producers is AngloAmerican, which operates the two haematite mines Sishen and Kolomela in the northern cape province in South Africa as well as the iron ore mines Minas Rio in the federal state of Minas Gerais in Brazil. In 2020, a total of 61 Mta were produced. The haematite ore in South Africa is processed in a dry process to a HQ lump ore with 64 % iron content and a sintered fine ore with 63.5 % iron content. For fine ore beneficiation, wet processes are used. Capacity at the Minas Rio is to be increased from 26.5 Mta capacity to 28 Mta in the forthcoming years. Ore is beneficiated in a wet process. Vertimills are used for tertiary grinding.

4.2 Brazil

The currently largest iron ore company in the world, Vale, is currently undertaking an extensive switch of its production in Brazil from wet to dry processing, In 2021 the company produced 275.5 Mta iron ore and 32.3 Mta iron ore pellets there. It has three mine complexes the Southeastern System (1) and Southern System (2) in Minas Gerais and the Northern System (3) in Pará (Fig. 13) with detected iron ore reserves of 3 859 Mt and assured reserves of 8638 Mt (as of 31.12.2021). The iron content of the detected reserves averages 46.2 % (1), 49.2 % (2) and 66.1 % (3). An important milestone in dry iron ore beneficiation was achieved by Vale with the Conceição Itabiritos project (Fig. 14) in Minas Gerais, which went into operation in 2014 and beneficiates iron ore with qualities > 40 % Fe.

Another important project has been given the name S11D (Fig. 15) and comprises the Carajás and S11D mines in the Federal state of Pará, where 200 Mta iron ore has been beneficiated in a dry process since 2018 [4]. So far, Vale already has 11 lines that operate based on the dry process. Another six lines currently operate based on the wet process. After 8 % waterless technology in 2008, by 2018 it had already reached 60 %, in the year 2024 the value at Vale should be 70 %. Vale’s goal is to produce premium products with up to 68 % iron content from the iron ore mines. This proved successful in 2021, with an average revenue of 140.4 US$/t for iron ore and 218,3 US$/t for iron ore pellets being generated. For this reason, for fine ore, other processes like dry magnetic separation and dry screening have been driven forward.

5 Outlook

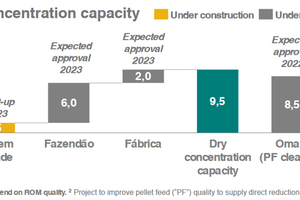

Dry iron ore beneficiation is without doubt currently being driven forward by Vale in Brazil. The company wants to increase its capacity from 340 Mta iron ore at present to 450 Mta in future, dry beneficiation is to be further increased by 10 % from 60 % at present. Dry beneficiation capacity will increase by around 110 Mta. An important role is being played by projects for iron ore concentrate extraction by means of dry magnetic separation (Fig. 16). Three projects with a total of 9.6 Mta are already in the construction phase, another project with 8.5 Mta capacity concerns the production of iron ore pellets. The most promising projects for iron ore beneficiation at Vale included Serra Sul (+ 18 Mta), S11D (+ 10 Mta), Capanema (+ 18 Mta) as well as other so-called replacement projects.

The ongoing exploitation of high-grade iron ore mines will force iron ore producers on other continents, too, to pay greater attention to their beneficiation technologies. This is forced by the fact that smelting of iron ore with lower iron content will entail ever higher costs and environmental emissions for blast furnaces. In recent times, this has increasingly led to considerable price reductions for lower iron ore qualities. One issue that especially iron ore suppliers from Australia have also felt the effect of. This explains, for instance, the activities of Rio Tinto and Fortescue.

Literature

[1] Harder, J.: Water management – Water scarcity in mining. AT MINERAL PROCESSING, 9/2014, pp. 76-88

[2] Harder, J.: Tailings management – Disposal of ore processing residues. AT MINERAL PROCESSING, 7-8/2018, pp. 52-65

[3] Gaines, E.: Positioning for the future. Presentation at Diggers & Dealers Mining Forum 2021, 4 August 2021. Kalgoorlie, Western Australia, Paper by Fortescue Metals Group, Perth/Australia

[4] Vale: Carajás S11D Iron Project – A new impetus to Brazil’s sustainable development, June 2012, Rio de Janeiro/Brazil

Author:

Dr.-Ing. Joachim Harder

OneStone Consulting Ltd., Varna/Bulgaria, www.onestone.consulting

Joachim Harder studied process engineering at Braunschweig University of Technology and earned his Ph.D. there. After more than 10 years working in industry in various management posts, in 1997 he established the consulting company OneStone Consulting. Dr. Harder is an acknowledged expert in international marketing, specializing in market analysis for business segment strategies. He is the author of diverse publications and a popular conference speaker.