Market Review Latin America

The mining sector in Latin America has long been a key economic factor. Years ago, there was talk of big mining boom there. Where does the mining industry there stand today? In the following report, insights are given into the leading countries, and major companies in the region are presented with their latest data.

1 Introduction

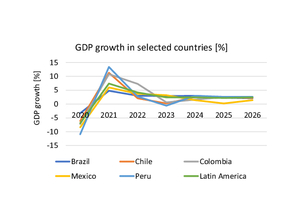

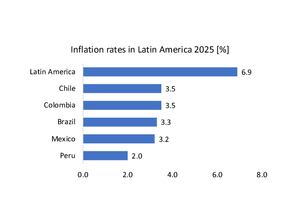

In this paper, we want to examine specifically the mining industry in Brazil, Chile, Colombia, Mexico and Peru. Following deep cuts in economic growth as a consequence of COVID-19, growth has now returned to pre-crisis levels (Fig. 1). For 2025, the IMF has forecast the highest growth of 2.6 % for Peru, followed by 2.5 % for Colombia, 2.4 % for Chile and 2.3 % for Brazil. The lowest growth of just 0.2 % is expected for Mexico. For Latin America overall, 2.4 % growth is forecast. With regard to inflation rates, however, the five countries mentioned above show much better...

![3 Sales in Brazil’s mining sector [3]](https://www.at-minerals.com/imgs/2/2/8/4/5/9/5/tok_6ae43b40adcae1985475f0d1850b6c9e/w300_h200_x297_y421_03_Harder_Umsatz_Brasil-b043cace713829c5.jpeg)

![4 Export volumes and revenues [3]](https://www.at-minerals.com/imgs/2/2/8/4/5/9/5/tok_afceb9a80b6fa4912d4a539323f57c4f/w300_h200_x297_y421_04_Harder_Export_Brasil-7535a3b4a6acdc0b.jpeg)

![5 Share of mining exports in Brazil’s total exports [3]](https://www.at-minerals.com/imgs/2/2/8/4/5/9/5/tok_f9f186a037e0af96acfb52bdc91059b8/w300_h200_x297_y421_05_Harder_Umsatz_Brasil-434f317cc6f6c834.jpeg)

![7 Share of the mining sector in Chile’s GDP [4]](https://www.at-minerals.com/imgs/2/2/8/4/5/9/5/tok_1815dbd949b0b75096d71ea3d0a25067/w300_h200_x297_y421_07_Harder_BIP_Anteil_Chile-4ccd26abfe6dbe9d.jpeg)

![11 Production values for mining products in Mexico [5]](https://www.at-minerals.com/imgs/2/2/8/4/5/9/5/tok_e32b46b47a45d1f5c497c9d1569bd047/w300_h200_x297_y421_11_Harder_Bergbau_Mexiko-11abec8f41be01ab.jpeg)

![15 Export value of mining products in Peru [6]](https://www.at-minerals.com/imgs/2/2/8/4/5/9/5/tok_cdbd6b685d327b91430cf736906b76c8/w300_h200_x297_y421_15_Harder_Export_Peru-5c9be96724e03a0c.jpeg)